Goods and Services Tax (GST)

Launch:

GST Bill Passed on Date:

The bill was passed by the Rajah

Sabha on 3 August 2016, and the amended bill was passed by the Lok Sabha on 8

August 2016. The bill, after ratification by the States, received assent from

President Pranab Mukherjee on 8 September 2016, and was notified in The Gazette

of India on the same date.

Sabha on 3 August 2016, and the amended bill was passed by the Lok Sabha on 8

August 2016. The bill, after ratification by the States, received assent from

President Pranab Mukherjee on 8 September 2016, and was notified in The Gazette

of India on the same date.

The GST was launched at midnight on

1 July 2017 by the President of India, Pranab Mukherjee, and the Prime Minister

of India Narendra Modi.

1 July 2017 by the President of India, Pranab Mukherjee, and the Prime Minister

of India Narendra Modi.

101 Amendment of GST:

Addition of articles 246A, 269A,

279A. Deletion of Article 268A .Amendment of articles 248, 249, 250, 268, 269,

270, 271, 286, 366, 368, 6 Schedule, 7 Schedule.

279A. Deletion of Article 268A .Amendment of articles 248, 249, 250, 268, 269,

270, 271, 286, 366, 368, 6 Schedule, 7 Schedule.

What is GST?

GST (Goods and Services Tax) is

the indirect tax reform of India. GST is a single tax on the supply of goods

and services. It is a destination based tax. GST has subsumed taxes like

Central Excise Law, Service Tax Law, VAT, Entry Tax, Ontario, etc. GST is one

of the biggest indirect tax in the country. GST is expected to bring together

state economies and improve overall economic growth of the nation.

the indirect tax reform of India. GST is a single tax on the supply of goods

and services. It is a destination based tax. GST has subsumed taxes like

Central Excise Law, Service Tax Law, VAT, Entry Tax, Ontario, etc. GST is one

of the biggest indirect tax in the country. GST is expected to bring together

state economies and improve overall economic growth of the nation.

GST is a comprehensive indirect

tax levy on manufacture, sale and consumption of goods as well as services at

the national level. It will replace all indirect taxes levied on goods and

services by states and Central. Businesses are required to obtain a GST

Identification Number in every state they are registered.

tax levy on manufacture, sale and consumption of goods as well as services at

the national level. It will replace all indirect taxes levied on goods and

services by states and Central. Businesses are required to obtain a GST

Identification Number in every state they are registered.

There are around 160 countries

in the world that have GST in place. GST is a destination based taxed where the

tax is collected by the State where goods are consumed. GST has been

implemented in India from July 1, 2017 and it has adopted the Dual GST model in

which both States and Central levies tax on Goods or Services or both.

in the world that have GST in place. GST is a destination based taxed where the

tax is collected by the State where goods are consumed. GST has been

implemented in India from July 1, 2017 and it has adopted the Dual GST model in

which both States and Central levies tax on Goods or Services or both.

SGST –

State GST, collected by the State Govt.

State GST, collected by the State Govt.

CGST –

Central GST, collected by the Central Govt.

Central GST, collected by the Central Govt.

IGST – Integrated GST, collected by the Central

Govt.

Govt.

UTGST – Union territory GST, collected by union

territory government

territory government

Impact of GST on Indian Economy:

GST offers

several benefits to our economy. Here are some key advantages:

several benefits to our economy. Here are some key advantages:

·

Create unified common national market for

India, giving a boost to Foreign investment and “Make in India” campaign

Create unified common national market for

India, giving a boost to Foreign investment and “Make in India” campaign

·

Boost export and manufacturing activity and

leading to substantive economic growth

Boost export and manufacturing activity and

leading to substantive economic growth

·

Help in poverty eradication by generating

more employment

Help in poverty eradication by generating

more employment

·

Uniform SGST and IGST rates to reduce the

incentive for tax evasion

Uniform SGST and IGST rates to reduce the

incentive for tax evasion

Impact of GST on Consumers:

GST is

also beneficial for consumers. Here is how it impacts the Indian consumers:

also beneficial for consumers. Here is how it impacts the Indian consumers:

·

Simpler Tax system

Simpler Tax system

·

Reduction in prices of goods & services

due to elimination of cascading

Reduction in prices of goods & services

due to elimination of cascading

·

Uniform prices throughout the country

Uniform prices throughout the country

·

Transparency in taxation system

Transparency in taxation system

·

Increase in employment opportunities

Increase in employment opportunities

Impact of GST on Traders:

GST is

also has some positive impact on traders. Let’s see how it affects the traders:

also has some positive impact on traders. Let’s see how it affects the traders:

·

Reduction in multiplicity of taxes

Reduction in multiplicity of taxes

·

Mitigation of cascading/ double taxation

through input tax credit

Mitigation of cascading/ double taxation

through input tax credit

·

More efficient neutralization of taxes

especially for exports

More efficient neutralization of taxes

especially for exports

·

Development of common national market

Development of common national market

·

Simpler tax regime and Fewer rates and

exemptions

Simpler tax regime and Fewer rates and

exemptions

0% Tax Rate Products:

1. Milk

2. Eggs

3. Curd

4. Lassie

5. Unpacked

Food grains

Food grains

6. Unpacked

Pannier

Pannier

7. Guar

8. Unbranded

Natural Honey

Natural Honey

9. Fresh

Vegetables

Vegetables

10. Salt

11. Kajal

12. Educations

Services

Services

13. Health

Services

Services

14. Children’s

Drawing & ColouringBooks

Drawing & ColouringBooks

15. Unbranded

Atta

Atta

16. Unbranded

Maida

Maida

17. Besan

18. Prasad

Palmyra Jaggery

Palmyra Jaggery

19. Phool

Bhari Jhadoo

Bhari Jhadoo

20. Palmyra

Jaggery

Jaggery

5% Tax Rate Products:

1. Sugar

2. Tea

3. Packed

Pannier

Pannier

4. Coal

5. Edible

Oils

Oils

6. Domestic

LPG

LPG

7. PDS

Kerosene

Kerosene

8. Cashew

Nuts

Nuts

9. Milk Food

for Babies

for Babies

10. Fabric

11. Spies

12. Life-saving

drugs

drugs

13. Raisin

14. Roasted

Coffee Beans

Coffee Beans

15. Skimmed

Milk Powder

Milk Powder

16. Footwear

(< Rs.500)

(< Rs.500)

17. Apparels

(< Rs.1000)

(< Rs.1000)

18. Coir Mats,

Matting & Floor Covering

Matting & Floor Covering

19. Agarbatti

20. Mishti/Mithai

(Indian Sweets)

(Indian Sweets)

21. Coffee

(except instant)

(except instant)

12% Tax Rate Product:

1. Butter

2. Ghee

3. Almonds

4. Computers

5. Processed

food

food

6. Mobile

7. Fruit

Juice

Juice

8. Packed

Coconut Water

Coconut Water

9. Umbrella

10. Preparations

of Vegetables, Fruits, Nuts or other parts of Plants including Pickle Murabba,

Chutney, Jam, Jelly

of Vegetables, Fruits, Nuts or other parts of Plants including Pickle Murabba,

Chutney, Jam, Jelly

18% Tax Rate Products:

1. Hair oil

2. Toothpaste

3. Soap

4. Pasta

5. Capital

goods

goods

6. Industrial

Intermediaries

Intermediaries

7. Ice-cream

8. Corn

Flakes

Flakes

9. Soups

10. Toiletries

11. Computers

12. Printers

28% Tax Rate Products:

1. Small cars

(+1% or 3% cress)

(+1% or 3% cress)

2. High-end

motorcycles (+15% cress)

motorcycles (+15% cress)

3. Consumer

durables such as AC and fridge

durables such as AC and fridge

4. Beedis are

NOT included here

NOT included here

5. Luxury

& sin items like BMWs, cigarettes and aerated drinks (+15% cress)

& sin items like BMWs, cigarettes and aerated drinks (+15% cress)

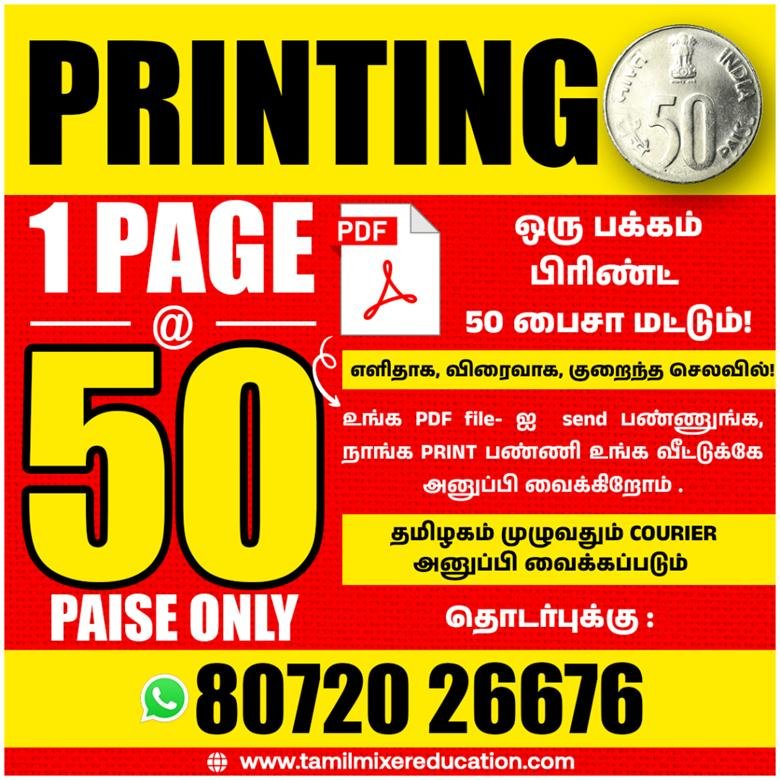

Click here to Download PDF

Check Related Post:

இனி நீங்கள் ஒவ்வொரு Exam Website.ஆக தேட வேண்டாம்🤩

எல்லாம் ஒரே இடத்தில் வந்து விட்டது

App download Link: Click here to Download

🔔 For more updates & free PDFs, join or follow us below 👇

💬 Join WhatsApp 📢 Join Telegram 📸 Follow Instagram ⭐ Add on Google